Reliance Industries: Is a Billion-Dollar Trading Blitz Hiding in Plain Sight?

"Reliance Industries is witnessing a frenzy of high-value trading, even as its stock price treads water. Are we witnessing a calculated power play by Mukesh Ambani, or something far more volatile?"

Key Takeaways

- •High-value trading activity at Reliance Industries, despite a stable share price, suggests a strategic move.

- •This activity could signal expansion, consolidation, or a major announcement related to one of its diverse business interests.

- •Investors should watch Reliance closely to anticipate market implications and potential shifts in the Indian economy.

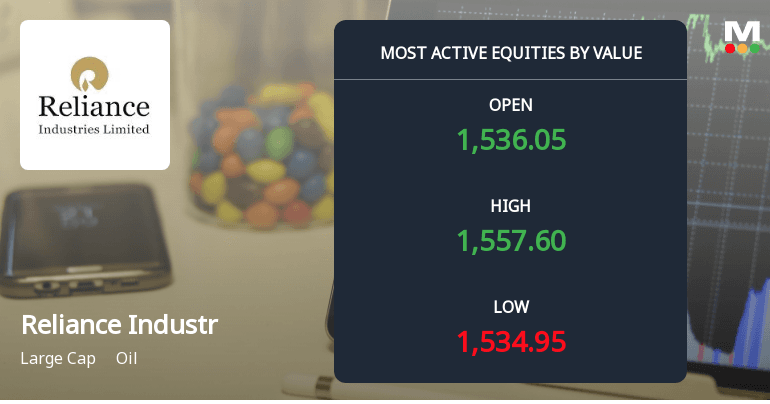

The market is abuzz. Not with the usual fanfare of soaring share prices, but with a different kind of electricity – the low hum of immense trading volume. Reliance Industries, the behemoth helmed by Mukesh Ambani, is the eye of this particular storm. While the stock price has been relatively stable, a deeper dive into the trading data reveals a flurry of high-value transactions, a stark contrast to the narrow price range. This begs the question: What's really happening inside the Reliance empire?

The Quiet Game of Giants

It's a classic tale of market manipulation, some would say. Or perhaps, a carefully orchestrated strategy. High-value trades in a narrow price range often point to a strategic accumulation or distribution of shares. When a stock price doesn't budge much, but the volume explodes, big players are moving around significant blocks of shares. This could be Ambani's team consolidating its position, preparing for a future expansion or a major strategic announcement. Or, on the flip side, is Reliance Industries quietly offloading shares, perhaps to fund a new venture or restructure its vast holdings? The answer, as always, lies in the data and a bit of informed speculation.

The situation's intrigue is amplified by Reliance's diverse portfolio. From petrochemicals and retail to telecommunications (Jio) and media, the company's tentacles stretch across the Indian economy. Any strategic move by Reliance has a ripple effect, impacting countless industries and millions of consumers. If Ambani is building a war chest, the implications are significant. It could signal aggressive expansion, a takeover bid, or a major technological leap. Conversely, if Reliance is shedding assets, it could indicate a strategic pivot or a defensive maneuver in a changing economic landscape.

Decoding the Market Moves

The markets are a complex beast, but understanding the core principles can reveal some patterns. High-volume trading in a tight price range suggests a battle between buyers and sellers. It's a tug-of-war, with both sides fiercely contesting the valuation. In Reliance's case, the stakes are colossal. Any significant shift in the company's valuation can move billions of dollars, impacting the fortunes of investors, the Indian economy, and of course, Ambani himself. There is potential for both immense opportunity and significant risk.

One potential scenario is related to Reliance's ambitious green energy projects. With massive investments in solar, wind, and hydrogen, the company is positioning itself as a leader in sustainable energy. This trading activity could be a prelude to a significant announcement in the green energy sector, aiming to consolidate its position and attract further investment. Another possibility is related to Jio, Reliance's telecom arm. With the rapidly evolving 5G landscape and increasing competition, Ambani may be looking to strengthen Jio's market share or acquire a smaller competitor. These are speculative, of course, but the high-volume trading serves as a compelling hint of future possibilities.

The Bottom Line

Reliance Industries is always in the news, but the latest developments are especially fascinating. The high-value trading amidst a narrow price range is a clear indicator that something significant is happening. It's a financial chess game, with Ambani making strategic moves that could reshape the Indian economy. Investors and market watchers alike should keep a close eye on Reliance's next moves. This isn't just about the stock price; it's about the future of India's business landscape. And the quiet, high-value trades might be the only clue we have to what is coming.