Reliance Industries: Is a $200 BILLION Power Play Brewing Behind the Scenes?! (You Won't Believe the Trading!)

"Reliance Industries, the behemoth controlled by Mukesh Ambani, is seeing a frenzy of high-value trades, yet the stock price barely budges. This strange paradox has analysts scrambling and whispers of a massive, strategic shift are reverberating through the markets."

Key Takeaways

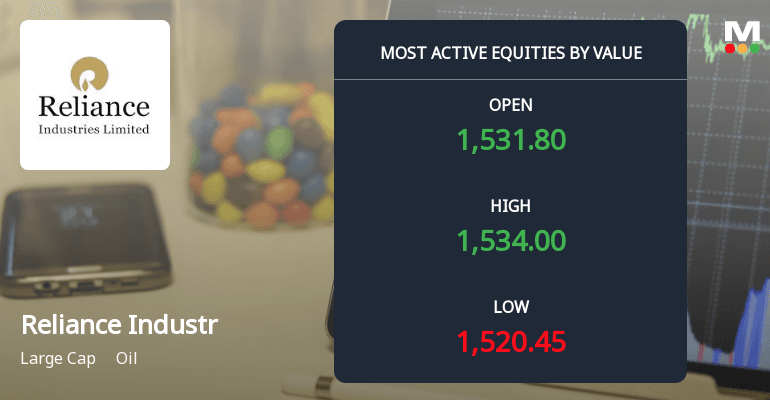

- •High-value trading is occurring in Reliance Industries despite a narrow price range.

- •Significant institutional interest suggests a strategic move is afoot.

- •The situation points to a potential major shift in Reliance's business strategy, and/or portfolio.

The Eye of the Storm: Reliance's Quiet Revolution

The markets are abuzz, but not in the way you'd expect. While the world's eyes are often glued to the day-to-day fluctuations of Reliance Industries (RIL), a far more intriguing drama is unfolding beneath the surface. According to Markets Mojo, a surge in high-value trading is occurring, even as the stock price stubbornly clings to a narrow range. This isn't your average market day; it’s a siren song, hinting at a seismic shift that could reshape the Indian economic landscape.

Big Money, Small Moves: The Institutional Dance

The key here is the ‘institutional interest.’ We're not talking about your average retail investor; we're talking about the titans of Wall Street and beyond. Pension funds, hedge funds, and sovereign wealth funds – the players who move billions with a single trade – are actively engaged. Their presence, coupled with the high trading volumes within a tight price band, suggests a carefully orchestrated strategy. Are they accumulating? Are they positioning themselves for something massive? The silence is deafening, and that's precisely what's so captivating.

Decoding the Ambani Advantage: What's the Endgame?

Mukesh Ambani, the visionary behind Reliance, is renowned for his strategic acumen and ability to anticipate market trends. What could be motivating this current flurry of activity? Is it preparation for a major acquisition? A bold expansion into a new sector? Perhaps a re-evaluation of Reliance's existing portfolio, shedding assets to fuel growth in more lucrative areas, like renewable energy or e-commerce? The possibilities are endless, and the speculation is rampant. The fact that the stock isn't reflecting these high-value trades is a significant tell - a strong sign that the moves are being controlled and managed carefully.

The Future is Now: What This Means for You

This situation presents a compelling case study in the dynamics of power and influence in global markets. It underscores the importance of looking beyond superficial indicators and digging deeper into the underlying currents. For investors, this is a clarion call to pay attention. Is this the calm before the storm? Is this the birth of a new era for Reliance? Only time will tell, but one thing is certain: the stakes are incredibly high, and the game is just getting started. Keep your eyes peeled – the next chapter in this financial saga is about to be written.