Musk's 'Womb' Declaration: A Calculated Provocation or a Fatal Misstep?

"Elon Musk's recent pronouncements regarding gender and biology have sent shockwaves through the tech and investment communities. This isn't just a PR blunder; it's a meticulously crafted strategy with potentially devastating consequences for Tesla's brand, valuation, and future. We dissect the man, the moment, and the monumental gamble he's taking in a world increasingly sensitive to inclusivity and social responsibility."

Key Takeaways

- •Elon Musk's recent statement has ignited a major controversy, jeopardizing Tesla's brand and financial prospects.

- •The incident underscores the growing importance of ethical leadership, stakeholder capitalism, and the impact of social media on business.

- •Tesla faces an uncertain future, dependent on its ability to navigate the complexities of the 21st-century business landscape and the behavior of its CEO.

The Lede: A Digital Inferno

The Twitter feed, usually a curated stream of rocket launches and meme-worthy pronouncements, erupted. Not with the usual fanfare of a new product launch or a triumphant stock surge, but with a digital conflagration. The match? A single tweet from Elon Musk: a declaration that the 'womb makes the woman,' a statement seemingly plucked from the annals of archaic biology. The response was immediate, visceral, and global. Heads exploded, not literally, of course, but the collective outrage, bewilderment, and outright anger from the digital chattering classes was palpable. The incident, far from being a simple slip of the tongue, sparked a firestorm that threatens to consume the very foundations of Musk's carefully constructed empire. This isn't just about a controversial tweet; it's about the erosion of trust, the potential for brand annihilation, and the complex interplay between a CEO's personal views and the financial health of a multi-billion dollar corporation.

The Context: From Disruptor to Divider

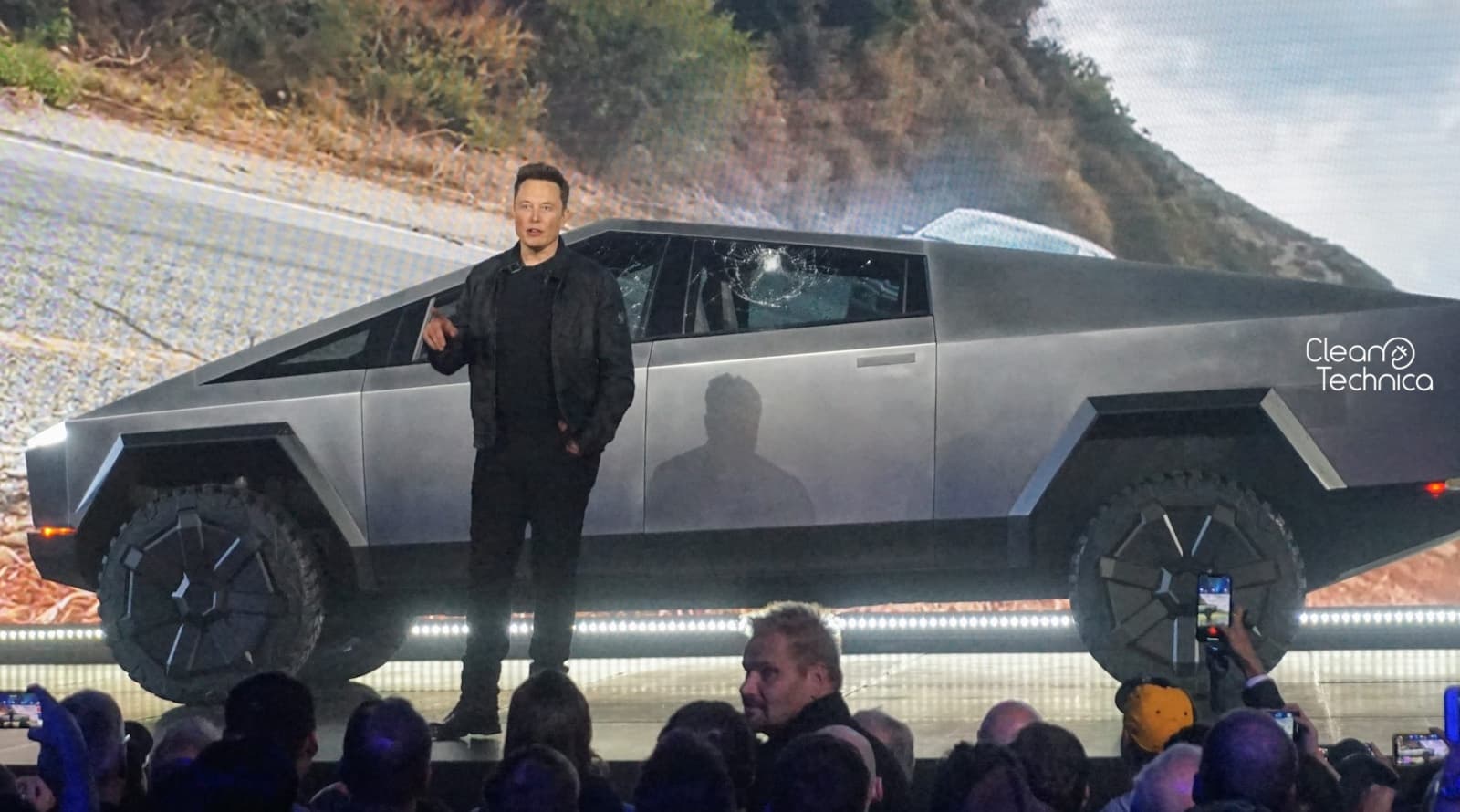

To understand the current crisis, one must trace the arc of Elon Musk's career. The early days were defined by audacious ambition and breathtaking innovation. Tesla, the electric car company that dared to challenge the established automotive giants, was a beacon of progress. SpaceX, with its reusable rockets, redefined the boundaries of space exploration. Musk was the ultimate disruptor, the modern-day Edison, captivating the world with his vision and bravado. He cultivated an image of the visionary, the rebel, the lone wolf who defied convention and achieved the impossible. Investors, consumers, and the media ate it up, rewarding his audacity with billions of dollars and unwavering attention. However, along the way, the narrative began to shift. The disruptor became more divisive. His pronouncements became increasingly erratic, his management style more autocratic, and his public persona, more unpredictable. The seeds of the current crisis were sown in this shift, as the lines between Musk the innovator and Musk the provocateur blurred, eventually becoming indistinguishable.

Consider the context: Tesla's market capitalization, once a testament to pure faith in innovation, is now inextricably linked to the perception of its CEO. A misstep, a controversial statement, a perceived lack of sensitivity – each can trigger a volatile reaction from shareholders, investors, and, crucially, the consumer base. This isn't just about the 'womb' tweet; it's about a pattern of behavior that has eroded the trust of key stakeholders. The relentless drive for disruption, once a strength, is now being perceived by some as a reckless disregard for social norms and ethical considerations. The automotive and tech sectors have become hyper-sensitive to ethical issues and societal viewpoints, making a misstep by a CEO even more damaging to the company.

The Core Analysis: Numbers, Narratives, and Hidden Agendas

Let's delve into the hard numbers. Tesla's stock performance, always volatile, is now potentially teetering on the edge of a precipice. Institutional investors, the lifeblood of the market, are increasingly risk-averse, particularly when dealing with companies whose fortunes are tied to the whims of a single, highly visible individual. ESG (Environmental, Social, and Governance) factors are no longer a niche concern; they are a central tenet of investment strategy. A company perceived as lacking in social responsibility – and Musk's recent pronouncements certainly fall into that category – faces significant headwinds. This impacts the company’s ability to secure financing, attract talent, and maintain consumer loyalty.

The narrative surrounding Tesla is also being rewritten. Once a story of innovation and environmental stewardship, it is now intertwined with questions of corporate governance, ethical leadership, and the CEO's personal views. The 'womb' tweet has become a focal point, a symbol of everything that is potentially wrong with Musk's leadership style. It has opened the door for critics to question his judgment, his values, and his ability to steer the company through turbulent waters. The agenda of short sellers, always lurking in the shadows, has been energized. They will undoubtedly be looking for any opportunity to capitalize on the perceived vulnerability of Tesla's stock, spreading negative news and exacerbating any existing downturn.

The hidden agendas are equally intriguing. Was the tweet a deliberate act of provocation? A calculated attempt to rally his base and distract from other pressing issues? A strategic move to position Tesla within a particular political landscape? Or was it simply a moment of unfiltered, uncalculated expression? The truth, as always, is likely complex. However, what is clear is that the consequences are far-reaching. The immediate impact is likely to be a decline in brand perception, particularly among younger consumers and those who prioritize social responsibility. This is especially damaging because this demographic is the leading edge of electric vehicle adoption.

Moreover, the incident has highlighted a critical vulnerability: the over-reliance on a single individual. Tesla's brand is inextricably linked to Elon Musk. His every move, every word, every tweet is scrutinized by the markets. This concentration of power is both a strength and a weakness. It provides Tesla with a clear vision and a charismatic leader, but it also exposes the company to significant risks. What happens if Musk's behavior becomes too erratic, too divisive, or too damaging to the brand? The board of directors has a clear fiduciary duty to protect shareholders and must consider the impact of Musk's behavior. The pressure is on them to intervene, either publicly or privately.

The "Macro" View: Reshaping the Automotive and Tech Landscape

This incident transcends the specific context of Tesla. It's a symptom of a broader shift in the business landscape. The line between business and politics, once distinct, is increasingly blurred. CEOs are no longer able to operate in a vacuum. Their personal views and public statements are now inextricably linked to their companies' financial performance. The rise of social media has amplified this trend, creating a 24/7 news cycle where any statement can go viral and where brand reputation can be irrevocably damaged in a matter of hours. The impact on Tesla extends beyond the automotive industry. It ripples across the entire tech sector, serving as a cautionary tale for other CEOs. This moment echoes the events of 1997 when Steve Jobs returned to Apple after a hiatus. However, the stakes are very different. Jobs had the support of the market and the belief in his vision. Musk, in many ways, is the victim of his own success. His behavior is now under a microscope, and he is losing the support of the market. The fallout could be felt throughout the electric vehicle market, where other manufacturers are now carefully considering their own brand messaging and the risks associated with controversial CEOs.

The incident also highlights the growing importance of stakeholder capitalism. Companies are increasingly being judged not just on their financial performance but also on their social and environmental impact. Investors are demanding greater transparency and accountability, and consumers are voting with their wallets. Tesla, once a poster child for sustainability, is now facing questions about its corporate culture and its CEO's values. This broader trend will continue to shape the business landscape, forcing companies to adopt more inclusive and responsible practices. The implications are profound. Businesses must invest in ethical leadership, diversify their boards, and prioritize the interests of all stakeholders, not just shareholders. Failure to do so will result in reputational damage, financial losses, and potentially, the obsolescence of the business.

The Verdict: A Forecast of Turbulent Skies

The future for Tesla is uncertain. In the short term (1 year), expect continued volatility in the stock price. The company will likely face increased scrutiny from investors, regulators, and the media. Attempts at damage control will be made, perhaps including a shift in public relations strategy or even a move by the board to exert greater control over Musk's communications. However, the damage is done. The initial shockwave of the 'womb' declaration will linger, casting a shadow over the company's brand and its ability to attract and retain talent. The electric vehicle market will become even more competitive, with traditional automotive giants increasingly investing in their own EV offerings. The advantage Tesla held will become less significant.

In the medium term (5 years), Tesla faces a fork in the road. If Musk can demonstrate a willingness to change his public behavior, to embrace more inclusive leadership, and to prioritize stakeholder capitalism, the company has a chance to recover. However, this is a significant "if." If he continues on his current path, the consequences could be severe. Tesla's brand will be permanently damaged, and its market share will decline. The company might be forced to merge with another entity, or its growth will be seriously impaired. Competitors will aggressively capitalize on any missteps, eating away at Tesla’s dominance. The once-unquestioned faith in Elon Musk's leadership will erode further, making it harder to attract top talent and maintain investor confidence.

In the long term (10 years), the future of Tesla hangs in the balance. The company will either emerge as a global leader in the electric vehicle market, or it will be relegated to a footnote in the history books. Success will depend on the ability of the company to adapt to the changing landscape, to embrace social responsibility, and to navigate the complexities of the 21st-century business world. The 'womb' tweet is a symptom of a deeper issue: the potential disconnect between a CEO's personal views and the financial health of the company. It serves as a reminder that even the most brilliant innovators are subject to the same rules of reputation management. As we’ve seen so many times, hubris is the most dangerous risk of all.