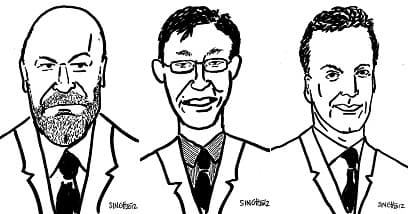

Biography

Clifford Asness is an American hedge fund manager and co-founder of AQR Capital Management. With a net worth of $2.9 billion as of October 2025, he is a prominent figure in the finance industry. Asness's wealth stems from money management and his success at AQR, a firm known for its factor-based investing strategies. His career includes early experience at Goldman Sachs Asset Management, followed by the founding of AQR Capital Management in 1998. He is an active researcher and has contributed to significant academic work in finance, earning him recognition and awards. Asness, an outspoken critic of high fees and regulatory capture, is known for his insights and commentary on the financial markets.